InsurTech London conference highlights

Last Friday, 22 Sept, great swathes of the London market left the familiar territory of EC3, to travel north to the depths of Shoreditch, to discover what’s new in the fast changing world of InsurTech.

With an absence of suits, dress down day for many, and an abundance of hipsters, t-shirts and sneakers it proved to be a day that lived up to the hype and more. With over 500 in attendance, 60 speakers and more InsurTechs than usual it was a day to remember. Sebastian De Zulueta, the organiser, must have been delighted.

Speakers and highlights

Top speakers presented, from leading incumbents like Munich Re and AXA, alongside InsurTech firms such as Slice Labs, TROV and Cuvva. Sabine van der Linden, Managing Director at leading accelerator Startupbootcamp InsurTech was also there to share her insights into this rapidly expanding sector.

Highlights for me were the Oxbow Partners presentation and panel talk on InsureTech: Hype or Impact, the Tiger Risk panel talk on Unbundling Insurance, which apparently is not as easy as it seems, with Jerad Leigh, head of innovation at Tiger Risk.

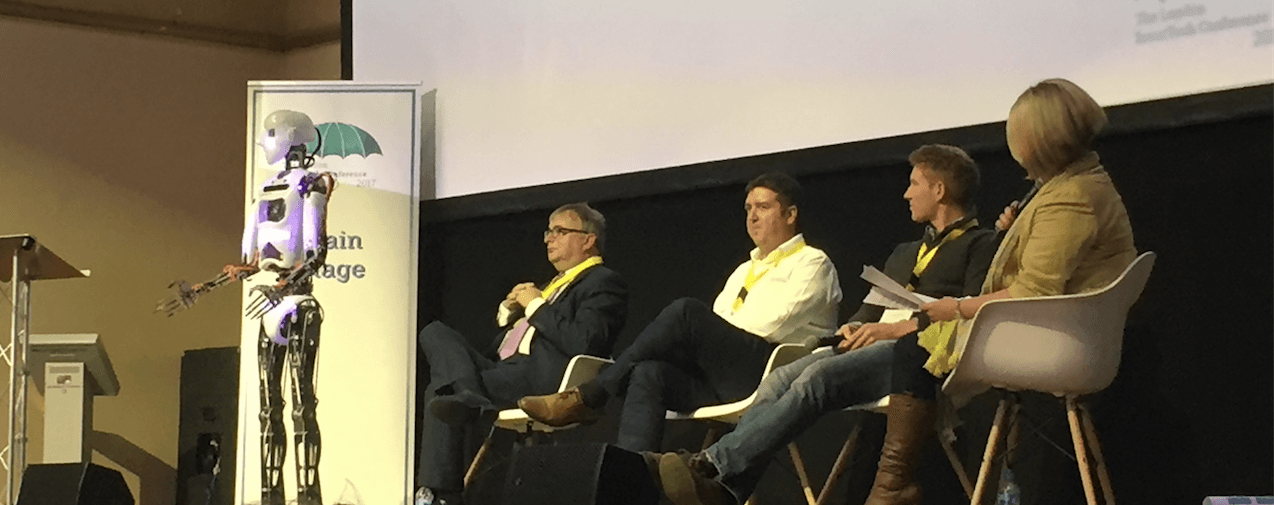

For the wow factor, however, the presentation by AI robot Boris, had to be the winner. Although it was so good, that there was lots of chat in the audience as to whether it was for real or was it run by a human operative behind the scenes!

InsurTech: the issues

The key issues of the day were around funding beyond the angel stage, which is apparently the biggest challenge currently facing InsurTech start-ups in London, according to so-sure CEO Dylan Bourguignon.

With all the capital in EC3, there must surely be some entrepreneurs out there looking to grasp the opportunity to invest in the future, particularly as it’s now clear that the vast majority of InsurTechs are looking to partner with the industry, not compete.

Many InsurTechs are seeking to use the latest technologies to drive down costs, engage with audiences better and offer greater insights with data analytics, what’s not to like.

Another barrier to entry for these startups, however, is regulation, according to Ambant CEO Chris Butcher. Start-ups can sometimes struggle to align their expectations with regulatory demands, he explained at the event.

Although the FCA is looking to support tech startups where they can, with their innovation hub, set up to fast track approvals, so it’s not all bad news. One InsurTech firm that I am currently working with, Marshmallow, has found them to be both supportive and responsive.

The good news

Later in one panel discussion, Slice Labs CEO and co-founder Tim Attia highlighted the competitive advantage technology can create for an underwriting entity. He said that if you created a digital insurer from scratch you could run an expense base which is 30 to 40 cents less on the dollar.

Now that prospect has to pique some interest in a sector that often struggles to make a good profit, with such tight margins!

The InsurTech sector is still a young one, but interest is clearly growing fast, so book early for next year’s event, as it looks set to be a sellout.

What next?

Feel free to drop me a line, whether you are an InsurTech looking to

raise your PR profile to support fund raising or attract insurance partners or an incumbent looking to position yourself as a

future leader in this rapidly developing sector.

NextGen Communications is currently working with InsurTechs, PR and business development, and the InsurTech press and we can support you with creating and distributing your news and views, via the press and social media.

News & Views