A super busy, yet successful ITC Vegas

Back in October, the insurance and Insurtech world once again converged at ITC Vegas 2024, the premier insurtech industry gathering attended by 9,000 professionals from across the globe.

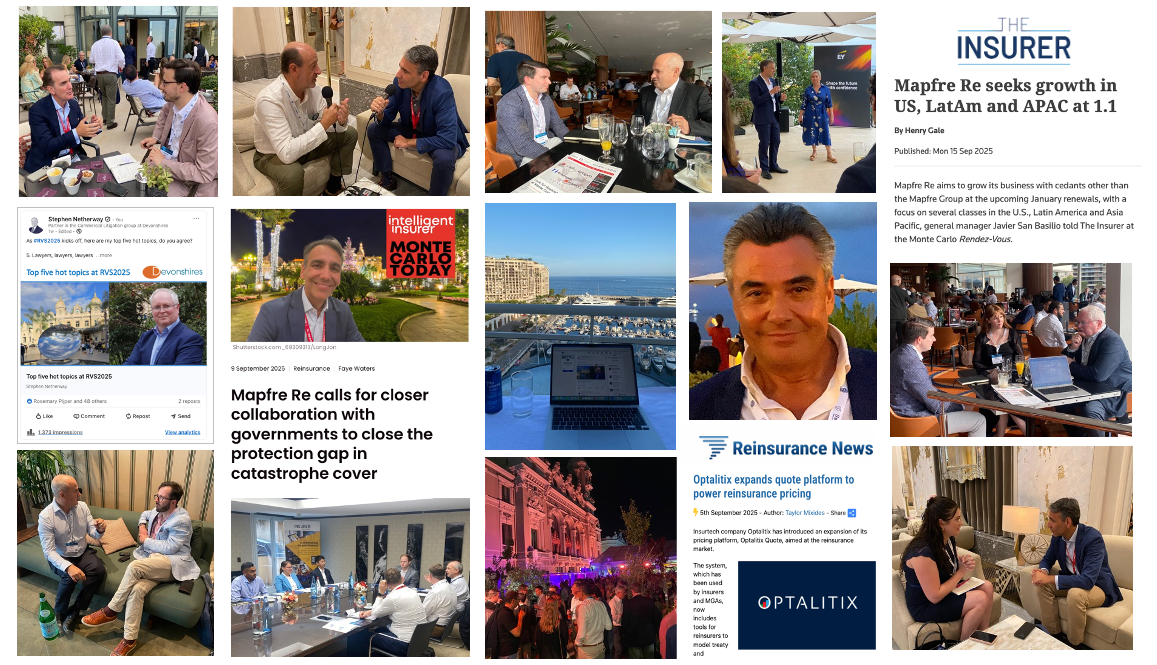

The NextGen Communications team was thrilled to represent our clients MAPFRE, Novidea, McKenzie Intelligence Services, Optalitix, and Transverse Ventures at this buzzing event, which we were attending for the third year in a row.

Driving visibility for our clients

The NextGen Communications' team, both in Las Vegas and here in the UK, orchestrated a packed schedule of press, podcast, and TV interviews for our clients. Thanks to collaborations with leading media outlets such as:

- Insurance Knowledge Hub

- Mergermarket

- Insurance Business America

- The Insurance Podcast Show

- Insurtech Leadership Podcast

- AM Best

...we ensured that our clients’ stories were shared widely and effectively with key audiences, at the event and beyond.

Engaging presentations that made their mark

MAPFRE and Novidea took centre stage with compelling presentations that drew packed audiences:

- Carlos Cendra Falcón, Scouting and Investment Lead at MAPFRE Open Innovation, delivered a keynote: ITC LATAM 2024 in Review alongside Hugues Bertin, showcasing key learnings and future directions.

- José Luis Bernal Zúñiga of MAPFRE US joined a panel discussion: Data Revolution in Claims: Unlocking Insights for Better Decision Making, diving into how data is transforming claims management.

- Jeff Heine, CRO at Novidea, captivated attendees during his panel discussion alongside other experts: ITC Brokers: Powering E&S Growth through Strategic Tech Investments, exploring how technology is revolutionising the broker space.

Behind the scenes

None of this would have been possible without the meticulous planning and execution by our stellar media consultants, Roma and Michelle. Their weeks of preparation ensured seamless coordination, allowing our clients to shine at the event.

A big thank you to them for their dedication and expertise.

Beyond the business

Of course, it wasn’t all work and no play. Some personal highlights included delightful dinners with our clients, a mesmerising visit to the Sphere Entertainment Co. for Postcard from Earth, and an unforgettable after party featuring the incredible Boys II Men.

Looking ahead to 2025

This year's ITC Vegas event generated a treasure trove of high-quality content, from thought leadership interviews to insightful articles, setting the stage for impactful conversations well beyond the event itself, as we now look ahead to next year.

If you’re planning to attend ITC Vegas 2025 or need public relations support in general, we’d love to help you amplify your brand and achieve your goals. Feel free to drop us a line—we’re already looking forward to making next year’s event even more successful!

Now back in Blighty, we’re reflecting on an extraordinary experience at ITC Vegas 2024. Here’s to more collaboration, innovation, and success in the year ahead.

News & Views