Is digital killing off the trade press?

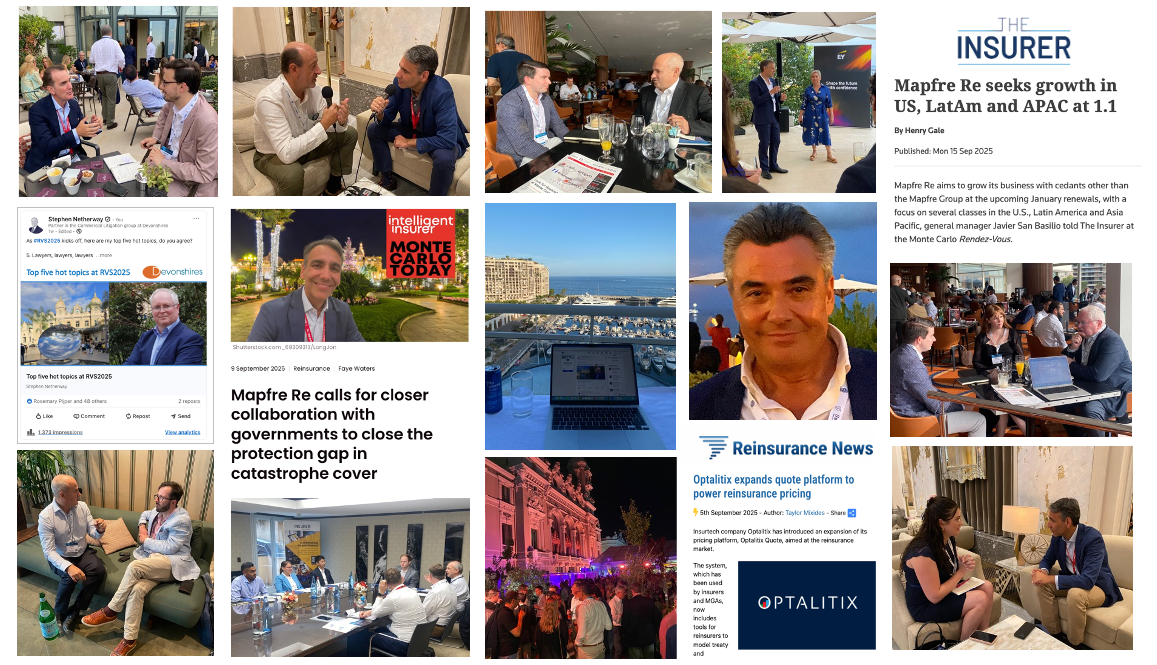

Here at the #RVS2019, every forward-thinking company having a digital strategy at the heart of its communications' efforts.

Many brokers and insurers are already very active with blogs and Twitter, and LinkedIn as a publishing platform.

So, does the drive to self-publish mean that the press, including the insurance trade press, have had their day?

Certainly the ability to self-publish is liberating. No longer do you need to wait for a publication to decide if your thoughts or story are worth printing.

You can publish and disclose what you want, when you want; to whom you want.

By choosing to self-publish across digital and social media channels you gain control. And that feels good, no?

What’s more, if you get your content right, your target audiences will engage with and, even better, amplify the reach of your communications, via their social media connections, as advocates of your business.

Now, at this point, you may be thinking I am advocating abandoning the insurance trade press. I am not.

In the digital age, how can the press add value?

If you are looking to build your brand the press is important, as it offers you an independent validated voice, which adds gravitas to your story, as well as giving you excellent reach to new audiences.

Leading publications such as the Insurance Insider, Insurance Day, Intelligent Insurer, Insurance Times, Strategic Risk and Post distribute content to over 100,000 industry professionals worldwide, with a social media following, to promote their content, to match.

When approached in the right way, with the right type of content; at the right time, the insurance press provides an invaluable channel for your communications. They will tell your story and enhance your profile.

In addition, the journalists at these publications, and others, are true content professionals, who on the whole do a great job of adding value to our industry. Journalists of this calibre produce high quality, professional content that your target audiences will read and engage with.

Your competitors understand the power of the press

Many of the major brokers and insurers understand the power of the press and hire expensive traditional PR agencies to support them or they have specialist in-house teams, including some with ex-journalists, who know how to hit the headlines.

You may not want, however, to spend £2.5k a month or more with a big PR agency and you don't have communications expertise in-house. So how do you compete?

The good news, if you want to feature in the top insurance publications, is that you do not need to hire full time in-house PR team or work with an expensive PR agency to compete with the big boys.

There’s a better, more cost effective way

You can work with a specialist insurance focused PR firm, like NextGen Communications, that understands your sector and can create communications to promote your business, products and services to both existing and new audiences, beyond your current social media reach.

All you need is a story to tell or solution to promote and we will do the rest.

We can provide copywriting support for social media and the press, sell-in news releases and thought-leadership articles and create opportunities for your specialists to comment in articles as industry experts.

Sound good? Then feel free to drop me a line to arrange a coffee and a chat at the Cafe de Paris or Fairmont hotel where NextGen Comms is based at #RVS2019, to discover what we can do for you within your budget. There's no time to lose.

Note: This article was originally published 2 years ago, and has been updated to reflect developments in communications in our sector.

News & Views